The multifamily real estate business is as straightforward as it gets: basic supply and demand.

Last week I attended the Middle Market Multifamily Conference, where owners, brokers and lenders from all over the country came to Florida to discuss where the multifamily market is headed. All that attended agreed that strong multifamily market fundamentals are poised to continue, and the demographic markers of renters have remained solid.

NEW CONSTRUCTION

Moving forward, as funding for new construction continues to reduce, the national demographic demand for apartments will not. Moving past election day, if the economy continues to strengthen, the gap between supply and demand will also continue to widen.

Construction of “A” apartments, which has mostly concentrated in the Central Business Districts of the larger cities, has slowed considerably. Construction spending recorded its first year-over-year decline since 2012, according to US Bureau of Economic Analytic s. Although these metros are seeing rents soften, the rent growth in our secondary markets remains robust.

DEMOGRAPHICS – Who’s driving demand?

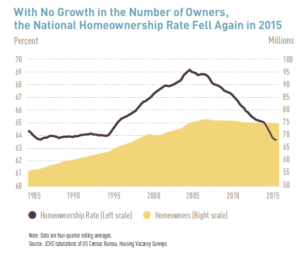

The Millennial generation is getting older, although they are waiting longer to get married and start a family, delaying a home purchase. Household creation has climbed back up to the average 1.2M per year, according to the Harvard Join Center for Housing Studies. However, after hitting a historic low of 62%, the home ownership percentage is not expected to climb past 64%, down from its inflated 69% at its peak.

That 64% number is considered the new normal.

That 64% number is considered the new normal.

Millennials are the most educated generation in US history, according to the US Census, 35% are college graduates.

Due to crippling student loan debt (average of $35,000) they cannot save for a down payment for a home. Due to their education, they want to be mobile to ensure employment in their field of study.

ARE THERE ANY VALUE ADD DEALS LEFT?

Owners agreed that there will always be deals with a value add component: properties will always be in need of capital improvements. What it comes down to is strategic market selection and specific property location. Through constant review of our deal pipeline, we have uncovered opportunities that others have overlooked. Bought at the right basis, with strong market demographics, there are still deals to be had.